ClearCheckbook Money Management

A leader in financial management tools since 2006. We Specialize in Budgets, Account Reconciliation, Spending and Saving Reports, Net Worth Metrics and More!

ClearCheckbook Money Management

- Create budgets

- View spending and income reports

- Manage your debt

- Track and pay bills

- Set reminders and recurring transactions

- Estimate future balances

- Import and export transactions

- View your account across all your devices

- We're free to sign up and start using

- Plus much more. Take a tour of our financial tools to learn more!

We're more than a simple transaction register

ClearCheckbook is your all encompassing financial management tool. While our foundation is a transaction register, we built many financial tools on top of that such as a Bill Tracker, Budgeting Tools, Reports, Investment Portfolio, Saving Goal Tracker and more.

Enter your transactions manually or connect your bank to ClearCheckbook and have your transactions automatically downloaded. Once your transactions are in ClearCheckbook, the full power of our financial tools becomes apparent.

ClearCheckbook is helping customers manage over 210 million transactions (and counting)! Sign up today and see how ClearCheckbook can help you with your financial goals.

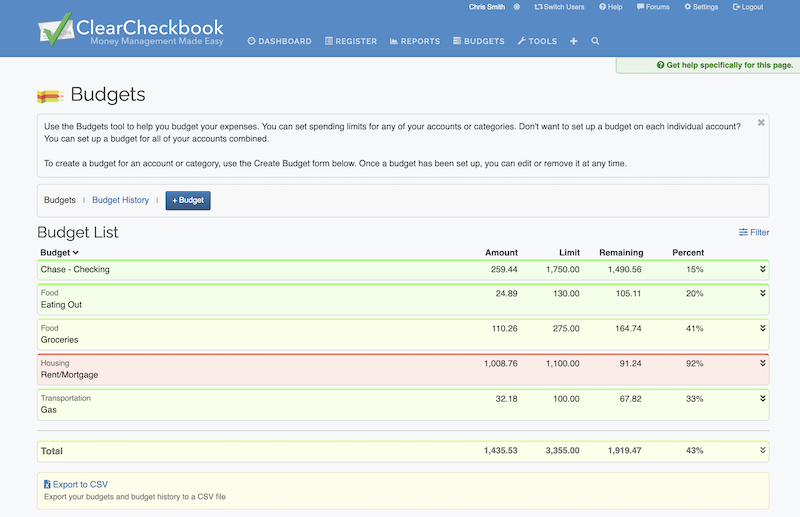

Use Budgets to Watch Your Spending

Get a better grip on your spending by setting up budgets.

You can also go back and look at previous months limits and how close to your limit you came. This is a great way of figuring out areas you can cut back in your spending.

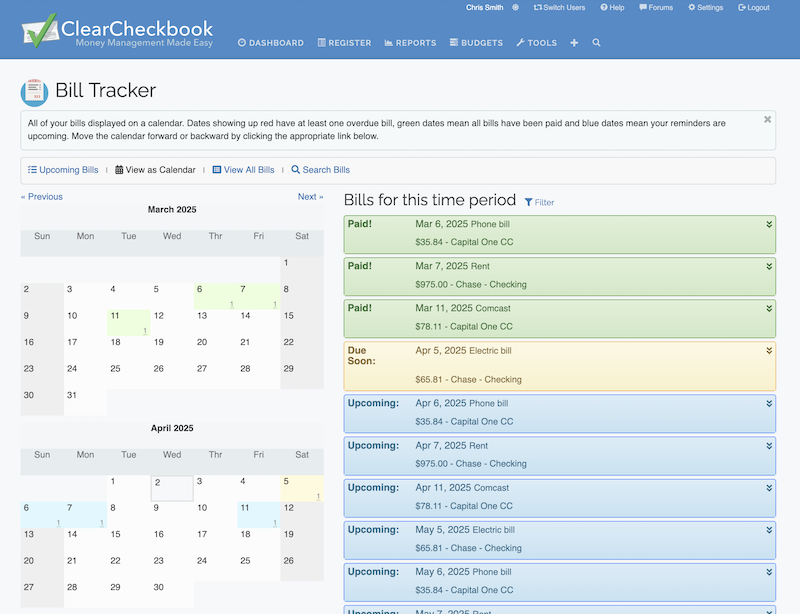

Track Your Bills

Keep track of which bills you've paid and find out which ones will be due soon.

The Bill Tracker can also easily be hooked into our Reminders and Recurring Transactions system so you can be notified whenever you have upcoming bills or you can have our system automatically post the transaction to your register.

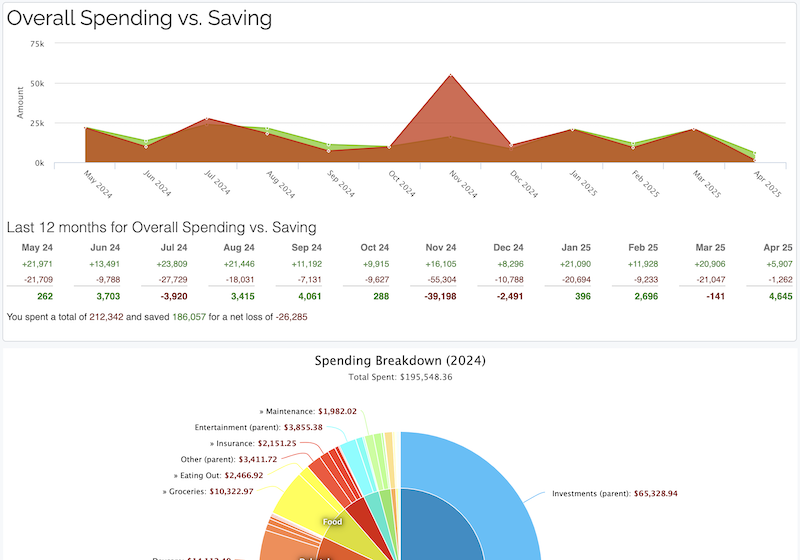

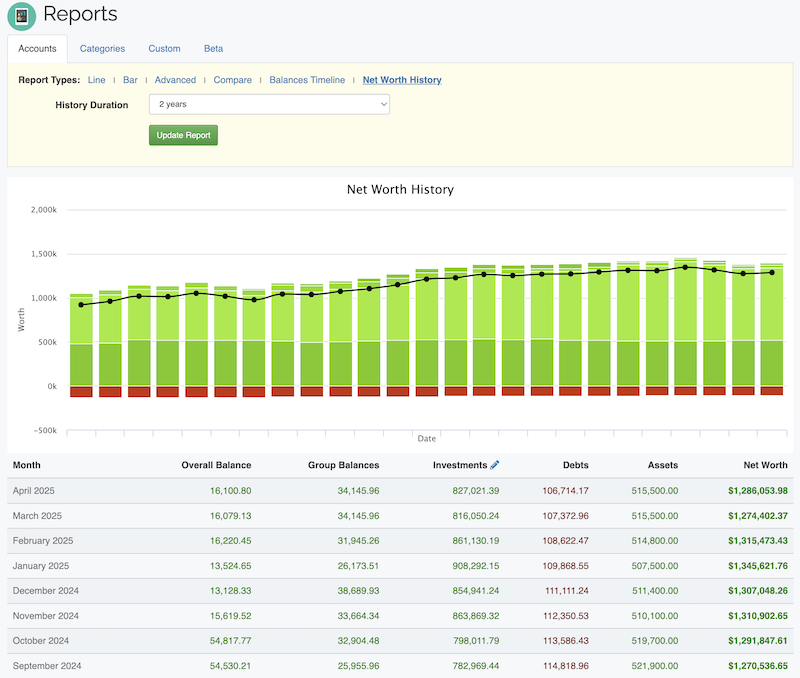

Track Your Spending and Saving

Our reports provide powerful insight into where your money is going and how much you're saving.

We make it extremely easy to find areas you can cut back on spending and make it easier for you to realize where to cut back in order to save money.

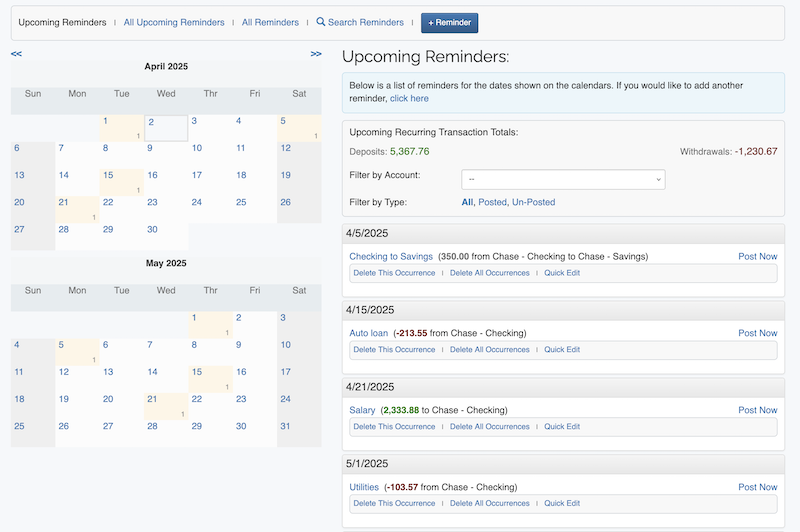

Schedule Transactions and Reminders

Automatically schedule salary deposits, utility payments and more.)

We can also take these recurring transactions and use them to project future balances so you'll have an idea of where your finances will be months from now.

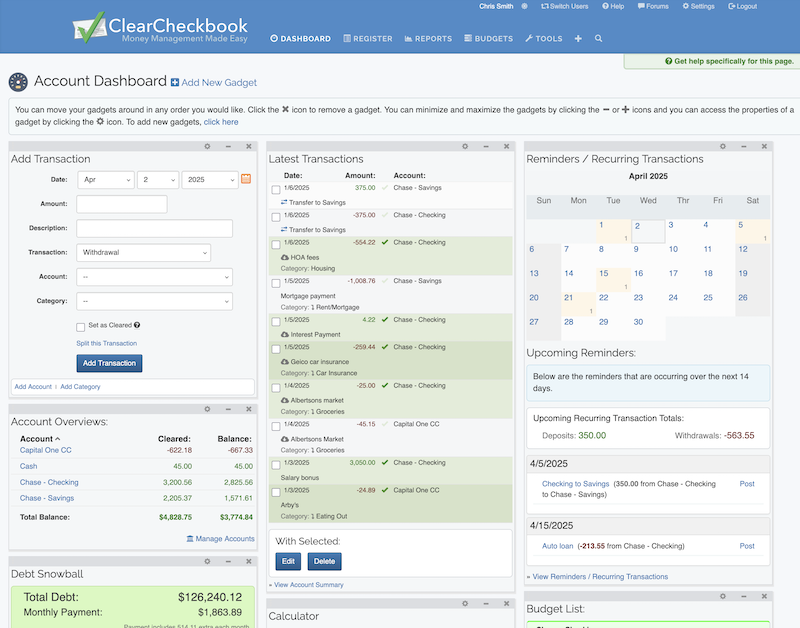

All Your Finances at a Glance

An overview of all your finances in one easy to find location.

You can do everything from adding transactions, balancing your checkbook, viewing reports, checking your balances, looking at your budget and more.

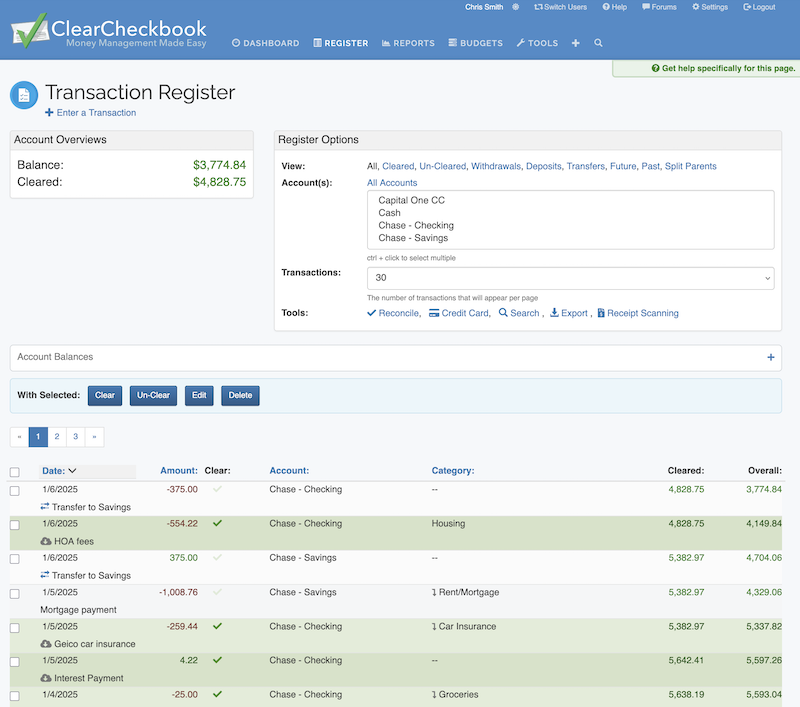

Balance Your Checkbook

The old fashioned checkbook register updated for the modern age.

We will calculate the overall balances for both your uncleared and cleared totals so you'll never accidentally overdraw your account again. This is also a great way of making sure the bank didn't make an error and charge you for something you didn't purchase.

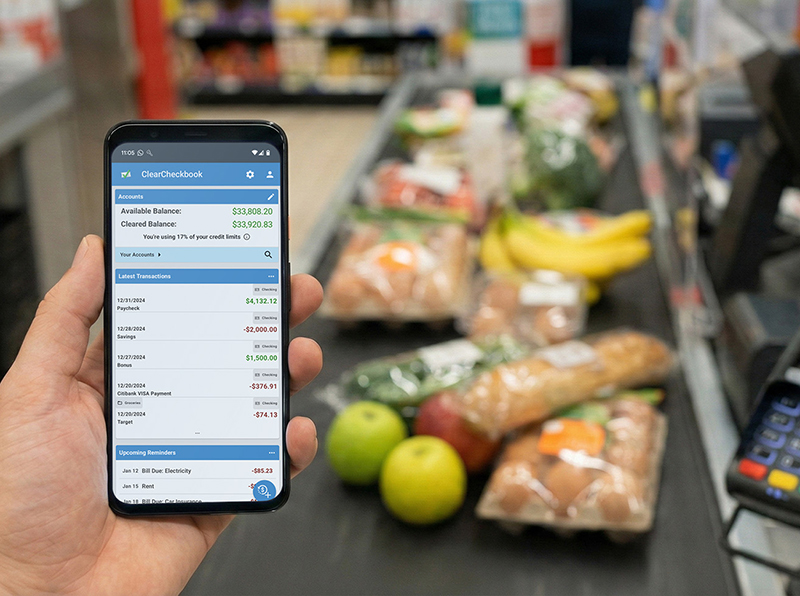

Financial Clarity in Your Pocket

See your complete financial picture at a glance. Easily record transactions, check your budget, and never miss a scheduled bill.

We have dedicated apps for both Android and iOS that provide a quick and easy way to manage your finances while you're on the go. Check your balances and enter transactions from anywhere, even the checkout counter!

Premium Features Available

We offer over 65 additional features, tools and settings with our ClearCheckbook Premium upgrade.

- Connect to your bank

- Running Balances

- Automatic Backups to Dropbox

- File Attachments for Transactions

- Transaction Histories

- Custom Fields: Check #, Memo and Payee

- Limit Histories

- Multiple users per account

- Estimating future balances

- Importing CSV files

- Over 60 additional tools, features and settings

Two Methods of Entering your Data:

Connect to a bank and sync your data

Manually enter or import your data

Privacy and Security Focused Money Management

ClearCheckbook is committed to keeping your financial data safe and secure. 256-bit SSL Encryption is always enabled when you're accessing ClearCheckbook. All sensitive data such as passwords are never stored in plain text anywhere on our servers. Added security features such as 2 Factor Authentication help give an extra layer of protection to your data as well.

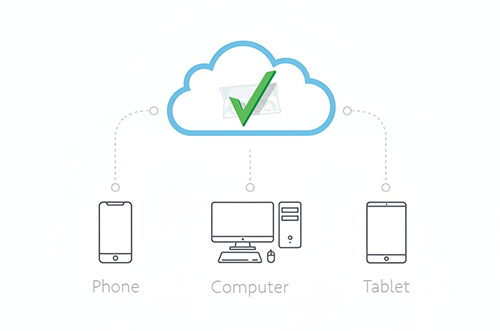

ClearCheckbook is Everywhere You Are

We make managing your finances easy by providing access to your data from any device that has internet connectivity. With ClearCheckbook you don't need to feel like all of your financial data is trapped on your PC.

ClearCheckbook.com is an extremely easy way to balance your checkbook online, track your spending, set a budget, manage your money and more. As an online checkbook, you enter your receipts into the site and assign each transaction to an account and category. You can go back through the online checkbook register and mark transactions as "Cleared". This way you will always know what transactions have been cleared with the bank and how much money you have. We also use the account/categories you assign a transaction to generate reports and use them for your budgets.

We encourage you to try the site out and see how it can help you manage your money and get your finances under control. The site is completely free to sign up and use. We also have some additional premium features that can be activated for a very small monthly payment.

In addition to our main website, we also offer money management applications built specifically for the iPhone, iPad, and Android mobile devices. All of our apps sync directly with the website so you'll always be on top of your finances.

Money management is more important now than ever. With everyone taking more of an interest in tightening their budgets, having a powerful tool at your disposal to track all your spending and saving, as well as viewing reports and setting budgets is extremely important. Take a tour of our financial tools and see if ClearCheckbook is the right tool for helping you manage your money.

Don't just take it from us...

Our customers are our biggest fans. Here's a glimpse at what some of them are saying.

"After testing several money management systems I stayed with ClearCheckBook because it's easy to use and very robust at the same time. For 4 years now it has helped me to control my personal finances to the point that every decision I now make about purchasing something I come to ClearCheckBook to see if i can afford it."

"I started using ClearCheckbook.com as a way to track my cashflow after I started working. It has now become a great way of knowing where my money is coming and going. ClearCheckbook allows me to have a snapshot of how much money I have and where I spend most of my money on each month."