Need help trying to figure out how to do something on ClearCheckbook.com? The tutorials might help!

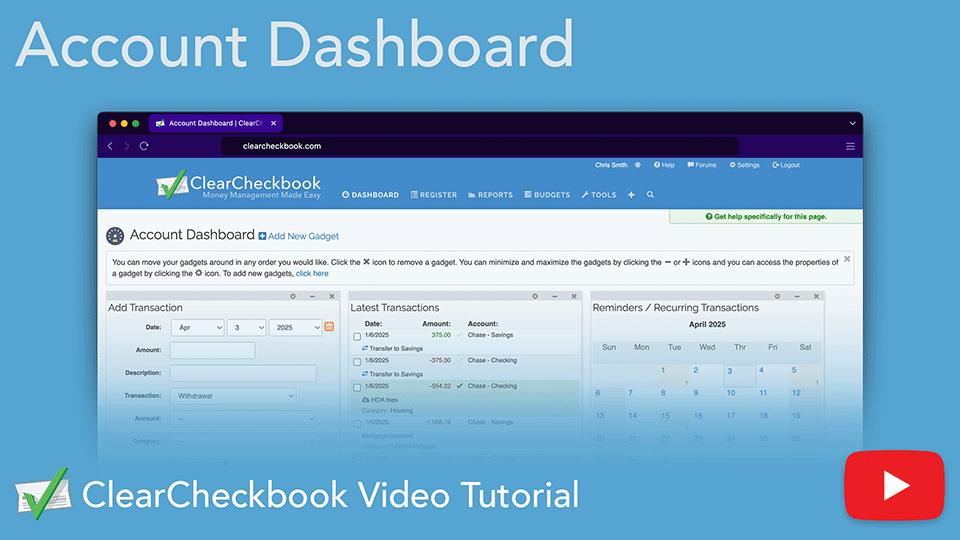

This video tutorial walks you through the basics of the Account Dashboard. It covers how gadgets interact with each other, modifying gadgets, adding new ones and customizing the number of dashboard columns shown.

Direct link to YouTube

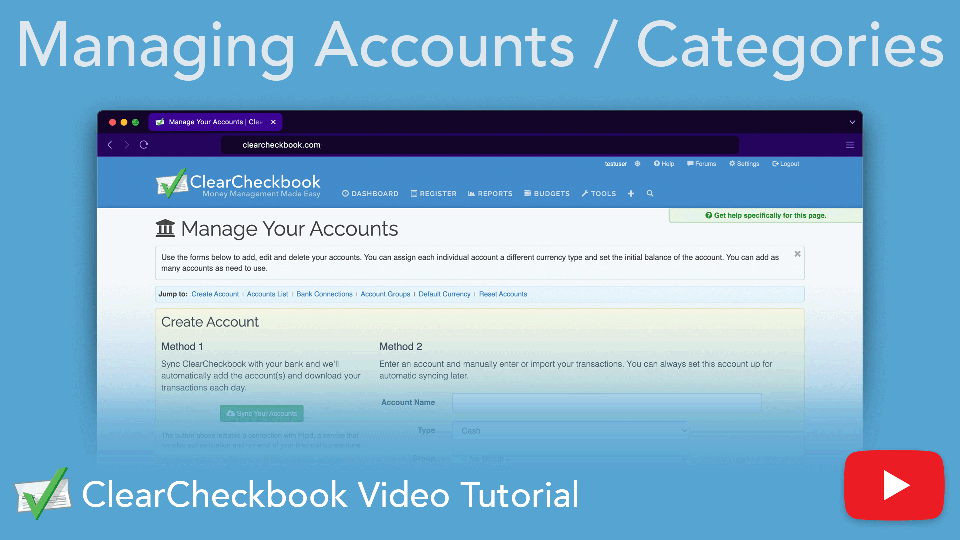

Learn how to manage your bank, cash and credit card accounts plus your spending and income categories.

Direct link to YouTube

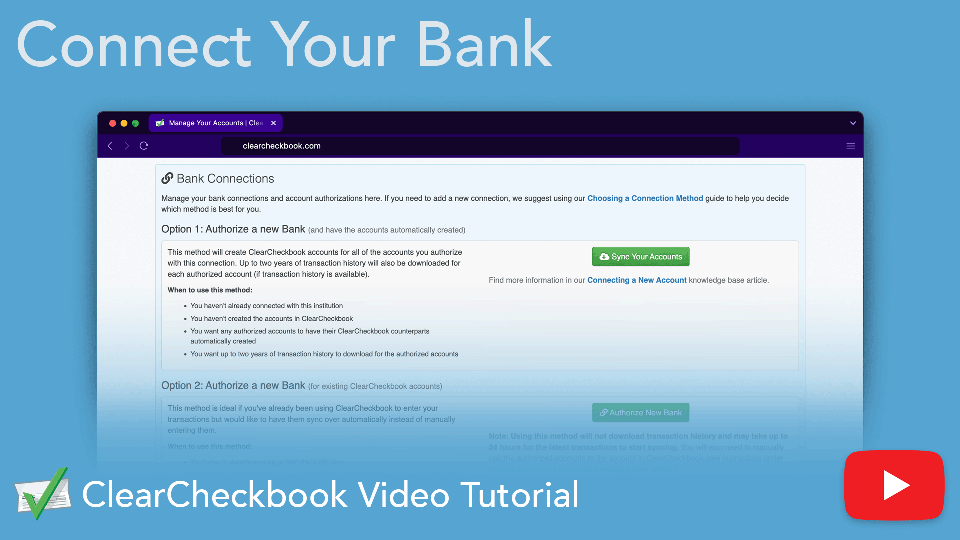

Learn how to connect your bank to ClearCheckbook and automatically sync transactions using Plaid. This video covers setting up connections, managing sync settings, categorization tools, and handling duplicates between manual and synced entries. Perfect for anyone looking to streamline their transaction management.

Direct link to YouTube

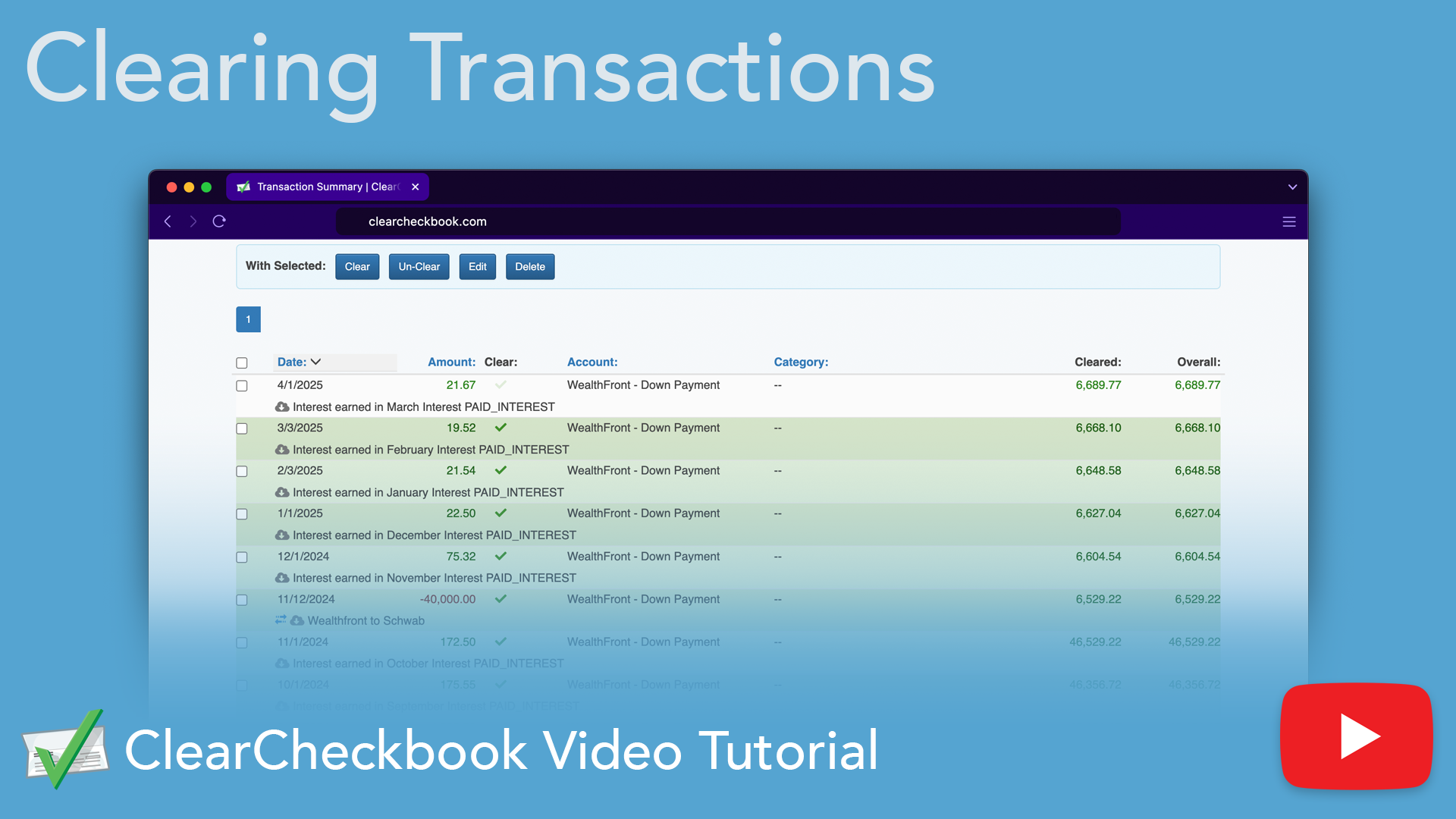

This tutorial walks you through how to reconcile your accounts in ClearCheckbook using the Clearing method. This process is as simple as checking off which transactions appear on your bank statement.

Direct link to YouTube

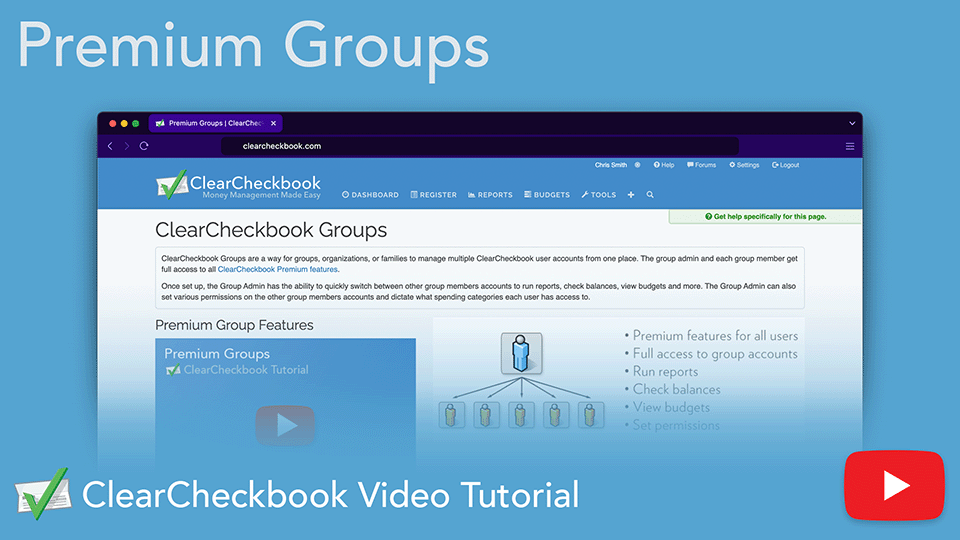

Discover how Premium Groups let caregivers, families, and organizations manage multiple ClearCheckbook accounts from a single login. Learn how to add users, customize their setup, and seamlessly switch between member accounts.

Direct link to YouTube

Forgot your password? Watch this tutorial to see how you can reset your password

Direct link to YouTube

Learn how to create a login and sign up for ClearCheckbook.com

Direct link to YouTube

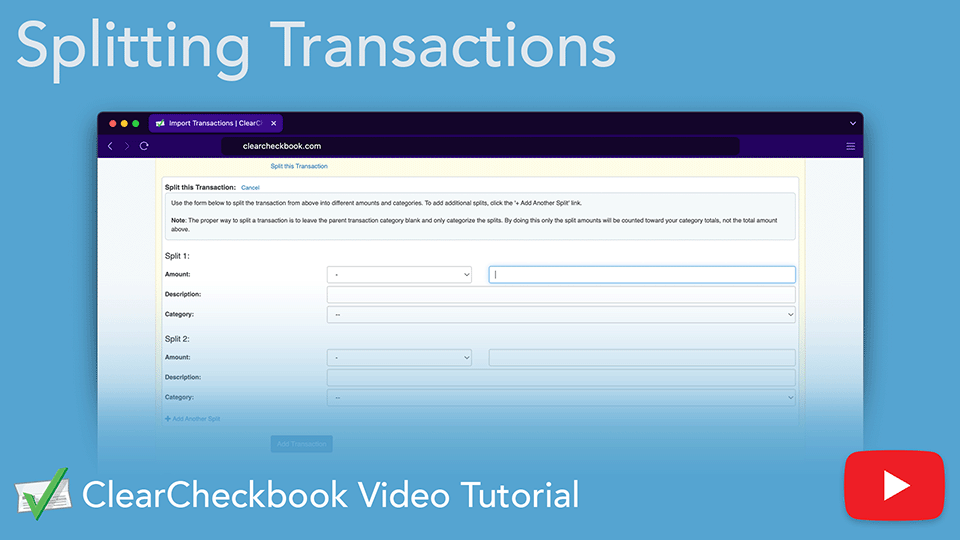

Easily divide a single transaction into multiple categories using our Split Transaction feature. Perfect for purchases that span groceries, clothing, pet supplies, and more. This feature lets you assign accurate amounts to each spending category. Splits update your budgets and reports automatically, giving you a clearer view of where your money goes.

Direct link to YouTube

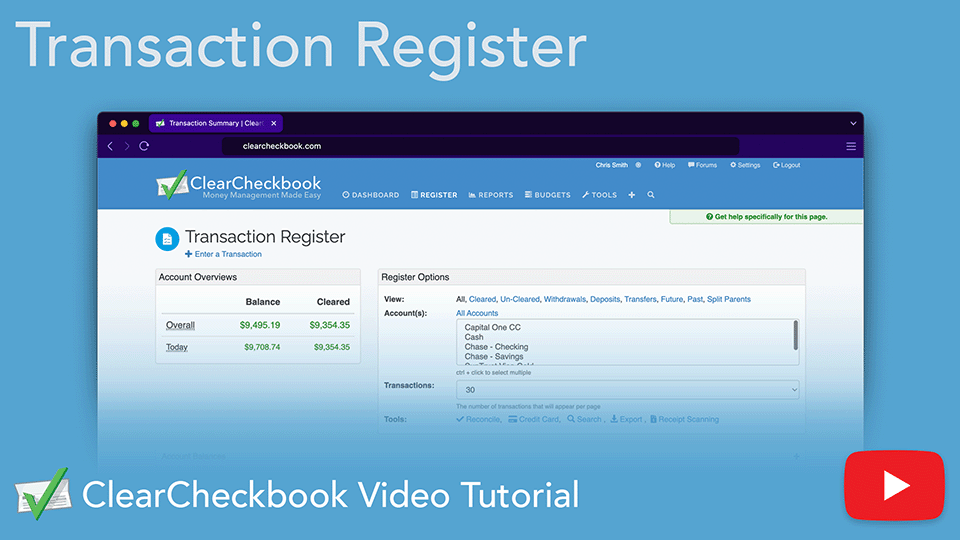

The Transaction Register is your central hub for managing finances in ClearCheckbook. View all your transactions, account balances, and upcoming transactions in one place. With powerful filters, custom layouts, and multi-account views, you’ll always know where your money is going. Track your past, plan your future, right from your register.

Direct link to YouTube

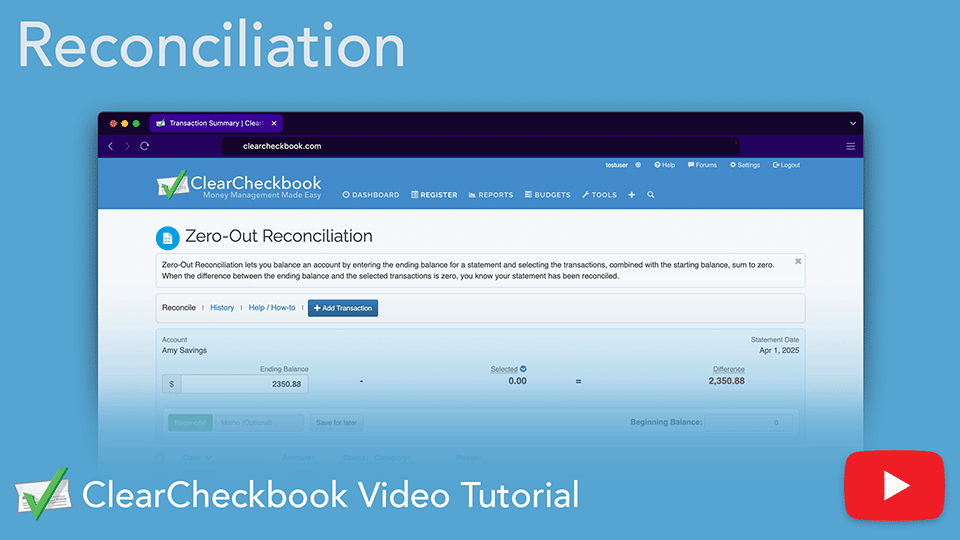

This reconciliation method has you enter the statement starting and ending balance and then select the transactions that appear on the statement. This video walks you through reconciling a statement using this method.

Direct link to YouTube

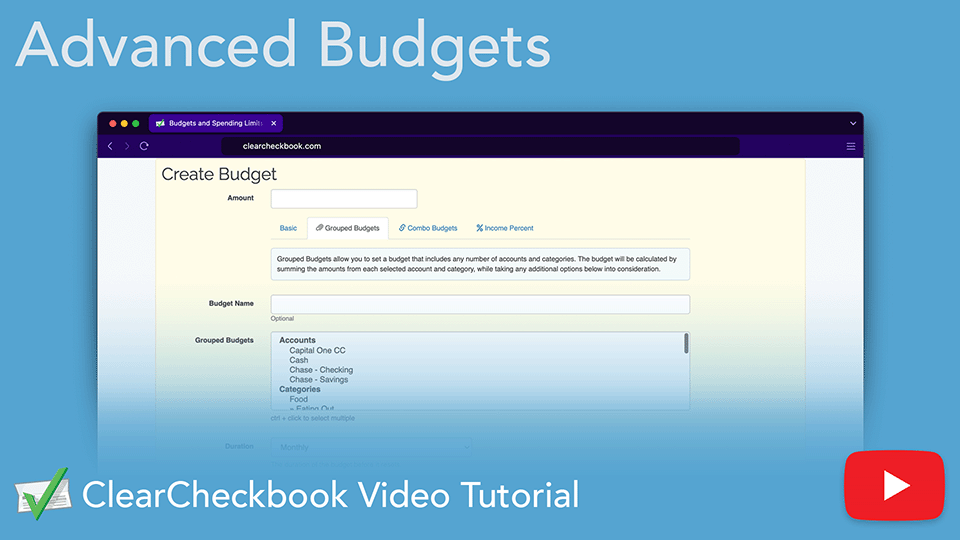

ClearCheckbook Premium introduces Advanced Budgets to give you more control over your finances. Choose from Grouped, Combo, Income Percent, or Income Budgets to customize how you track and plan spending. Whether you're managing shared expenses, limiting category-specific spending, or aligning budgets with income, these tools help tailor your budget strategy to fit your financial goals.

Direct link to YouTube

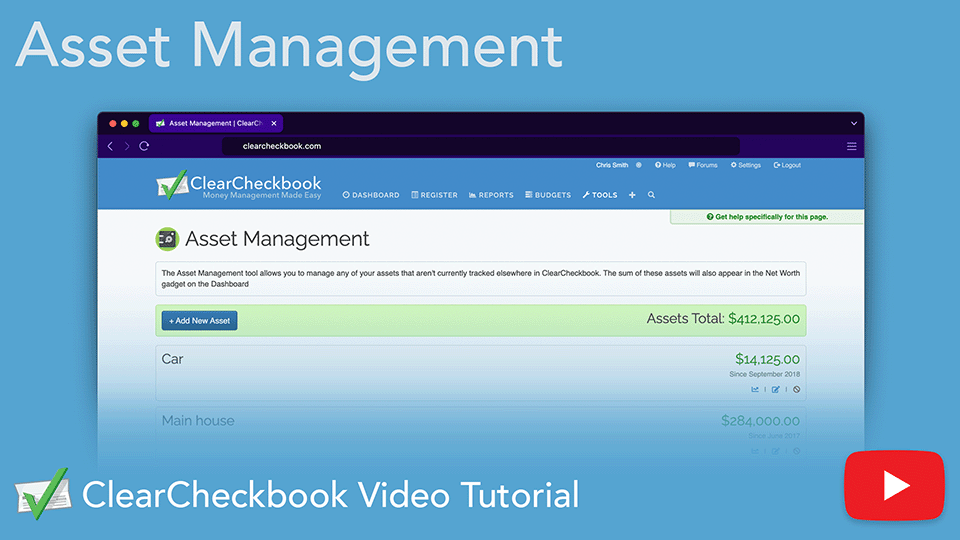

Make your Net Worth truly reflect your financial reality with our Asset Manager. This tool lets you easily track valuable assets like your home, car, or collectibles by logging purchase values, monthly estimates, and sale history. Update asset values over time and see them integrated directly into your Net Worth reports. A must-have for complete and accurate wealth tracking!

Direct link to YouTubeThis video shows you how to manage and track your bills using ClearCheckbook's Bill Tracker tool. Learn how to set up recurring payments, view upcoming bills, and avoid late fees with smart reminders and flexible payment options. Stay organized and in control of your finances with ease.

Direct link to YouTube

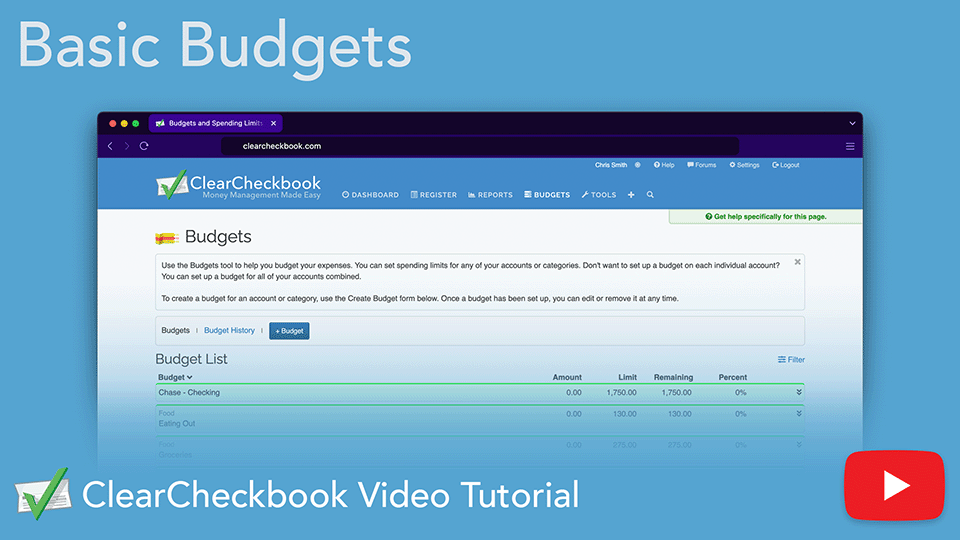

Use our Budgets tool to manage spending across categories like groceries, clothing, or dining. Budgets auto-update with each transaction and offer features like rollovers, income tracking, deposit adjustments, and forecasting tools. Visual cues and reports make it easy to stay within your limits and make smarter financial decisions.

Direct link to YouTube

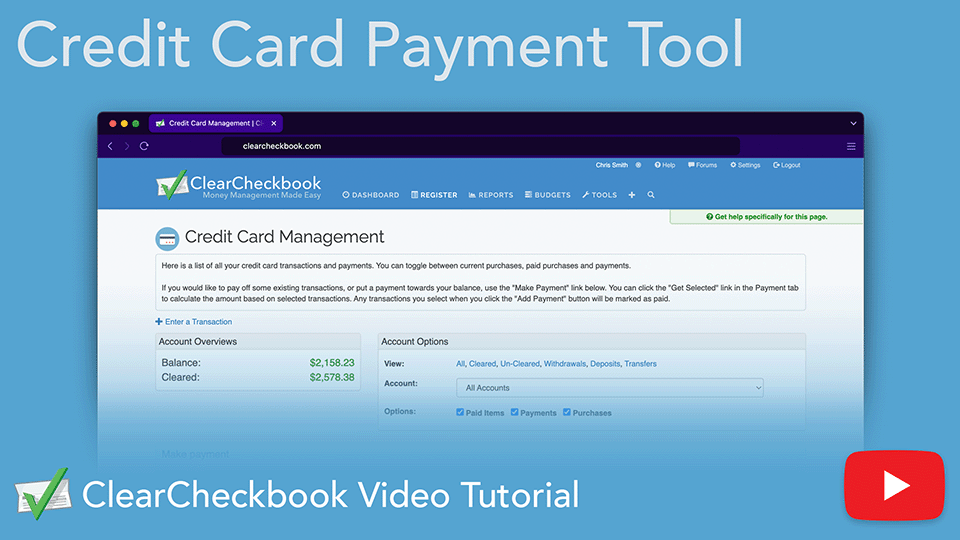

Our Credit Card Payment Tool helps you stay on top of your credit card balances. Select statement transactions, match totals, and log payments as transfers between accounts. See exactly which purchases have been paid off, all clearly marked in your transaction register.

Direct link to YouTube

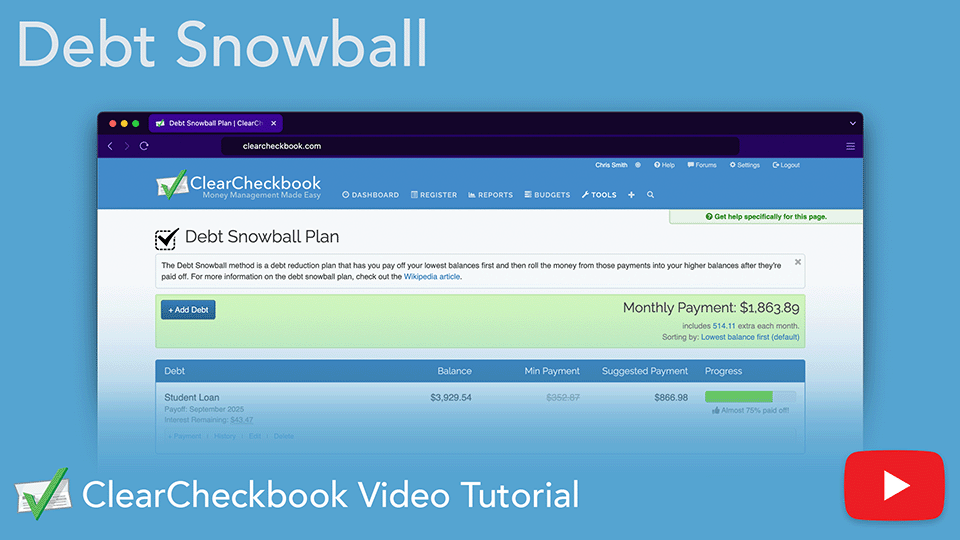

Our Debt Snowball tool helps you visualize and accelerate your debt payoff using the proven snowball method. Add your debts, track progress, adjust payment strategies, and see how much time and interest you can save. Stay motivated with clear insights and a personalized plan to become debt-free faster.

Direct link to YouTube

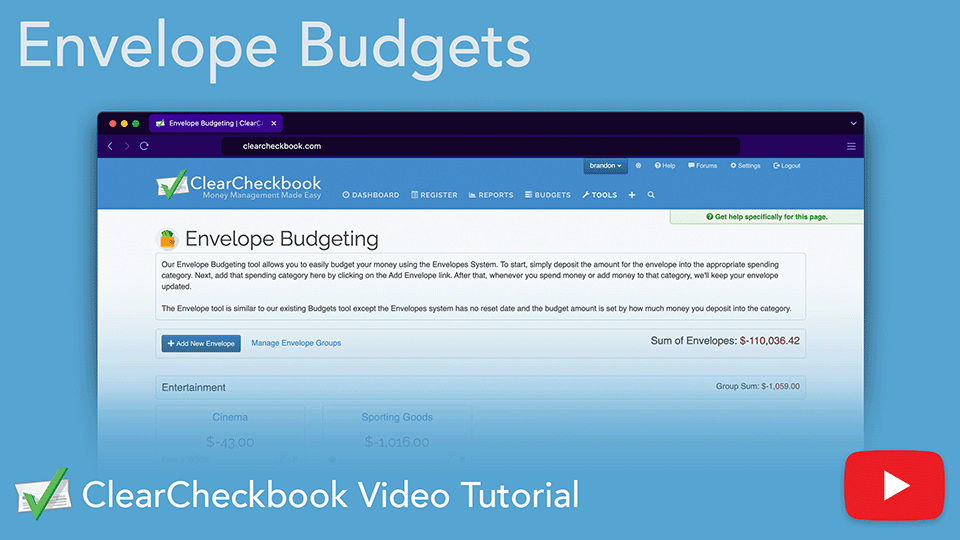

Take control of your finances with our Envelope Budgets tool. An intuitive way to track spending using digital cash envelopes. Set up category-based budgets, fund them through income splits, and monitor your progress to avoid overspending. Perfect if want visibility, structure, and smarter budgeting all in one place.

Direct link to YouTube

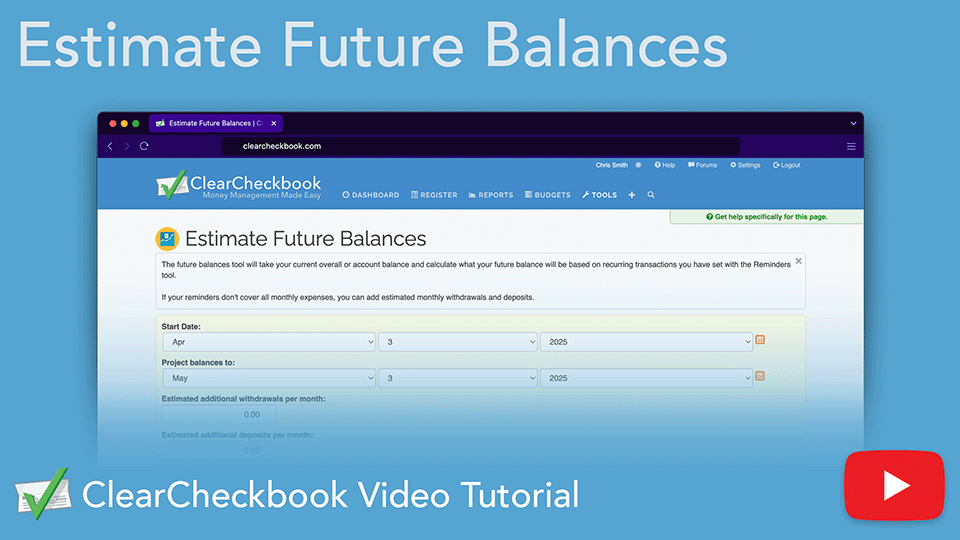

Take the guesswork out of your financial planning with our Estimate Future Balances tool. Project your account balances for any date by factoring in unpaid bills, scheduled transactions, and estimated expenses. With visual reports and monthly breakdowns, you’ll gain clarity and confidence in managing your cash flow.

Direct link to YouTube

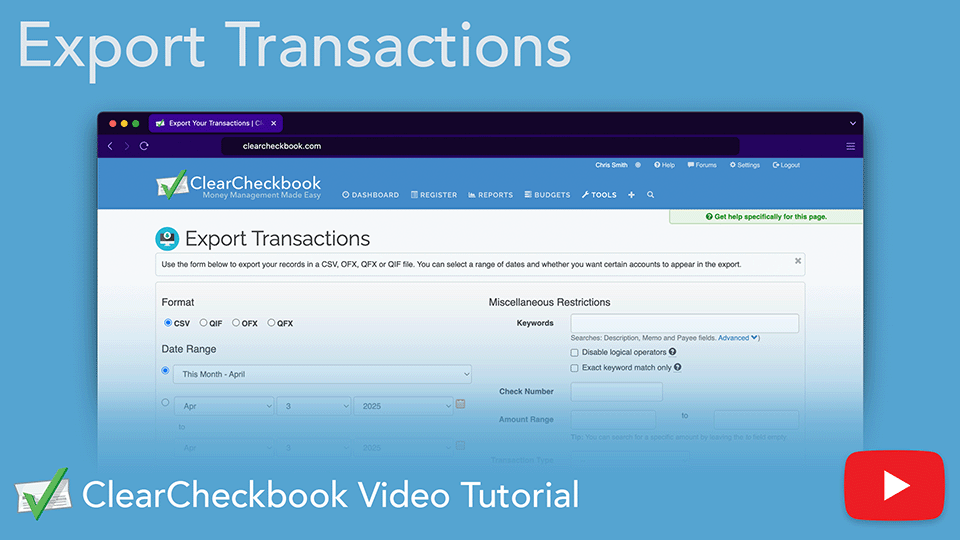

Learn how to export your ClearCheckbook transactions to a CSV, QIF, OFX, or QFX file for taxes, analysis, or backup. This video shows multiple ways to export and how to filter transactions by date or type for more control.

Direct link to YouTube

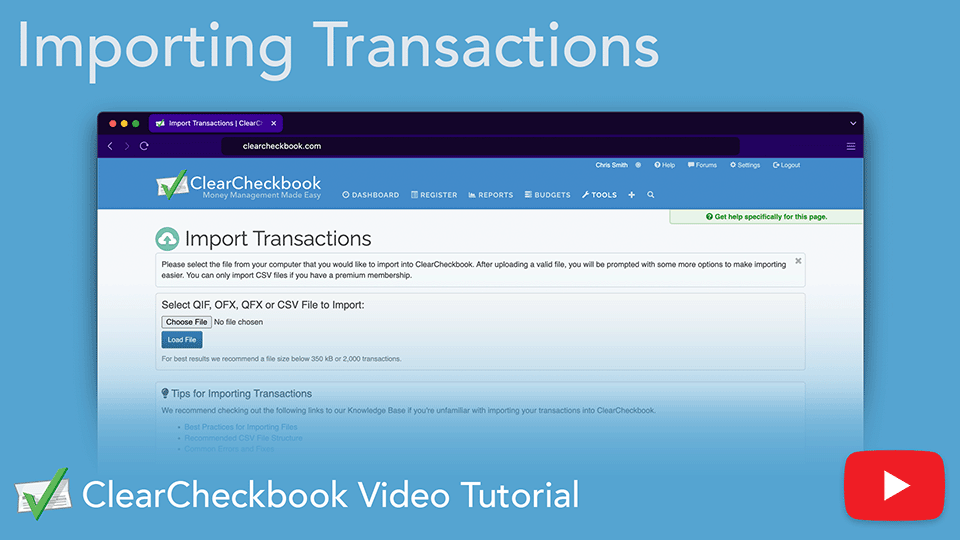

Watch this video tutorial to learn how to import transactions from your financial institution or other money management application into ClearCheckbook.

Direct link to YouTube

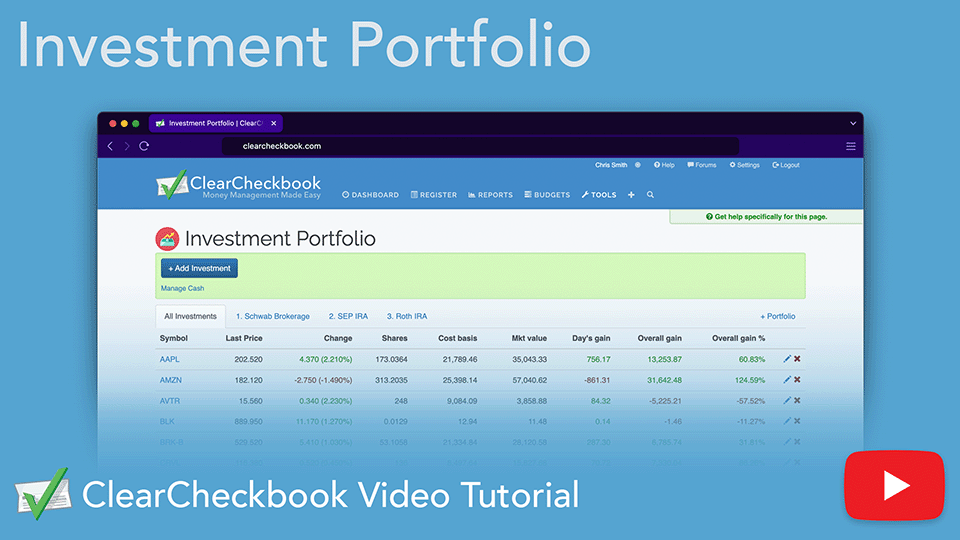

Take control of your investment tracking with our Investment Portfolio tool. Log your trades, manage multiple portfolios, track cash balances, and handle complex updates like stock splits. Your investments are seamlessly included in your Net Worth, with monthly historical tracking for a complete financial overview. Ideal for anyone who wants clarity and control over their investments.

Direct link to YouTubeKeep personal loans clear and easy with our Money Lending Tracker. Whether you're lending or borrowing, this tool helps you log every detail like names and amounts to deadlines and repayment history. Quickly update repayments, track remaining balances, and see overdue items at a glance. Stay organized, transparent, and stress-free when it comes to money between friends.

Direct link to YouTube

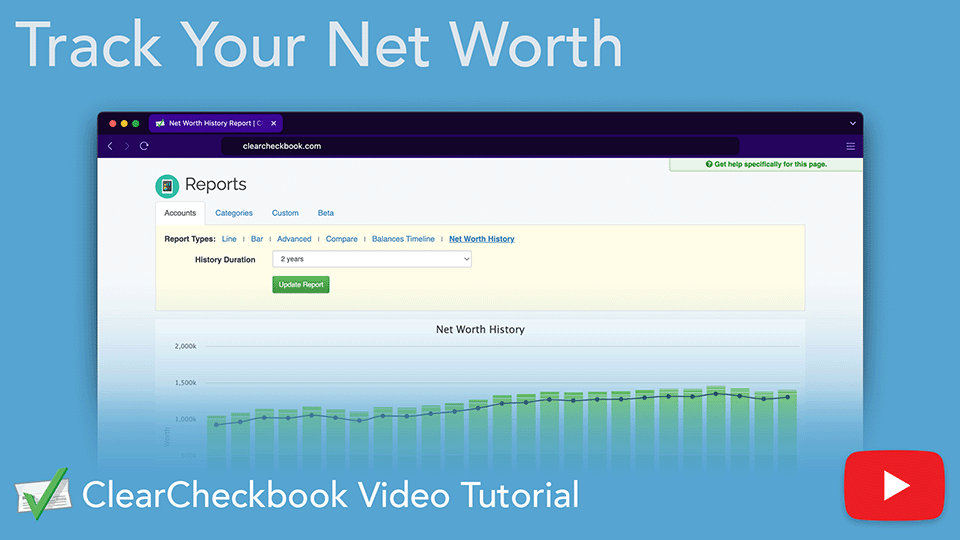

Track your total financial health with our Net Worth tool. Combine account balances, investments, debts, and assets to see how your wealth evolves over time. With detailed reports and a real-time dashboard gadget, you’ll always know where you stand financially, and how to grow from there.

Direct link to YouTube

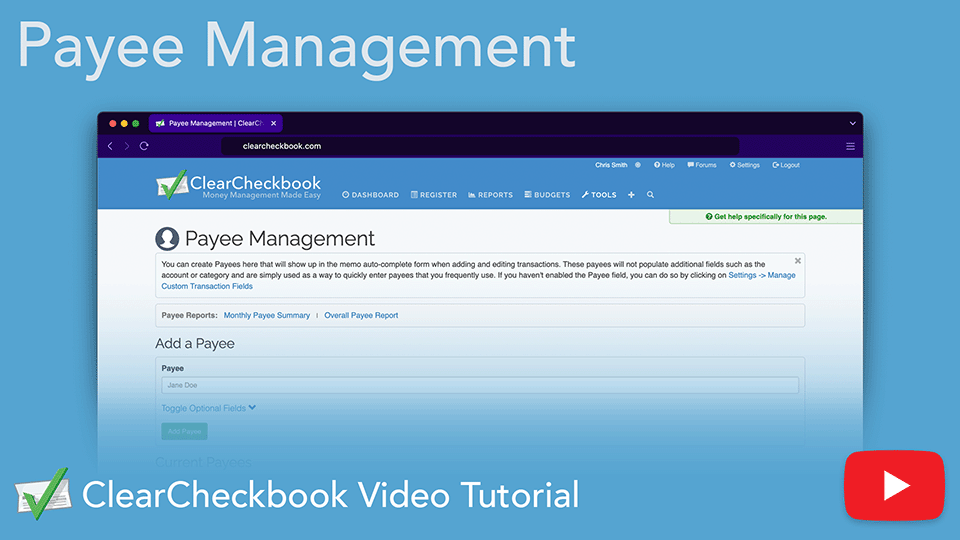

Take control of who you're paying and how much with ClearCheckbook's Payee Management tool. Add detailed info for each payee, streamline transaction entry, and unlock insightful payee-based reports. View totals by month, account, or category, and import existing payees with a click. Whether managing bills or business expenses, this tool helps you track where your money's going.

Direct link to YouTube

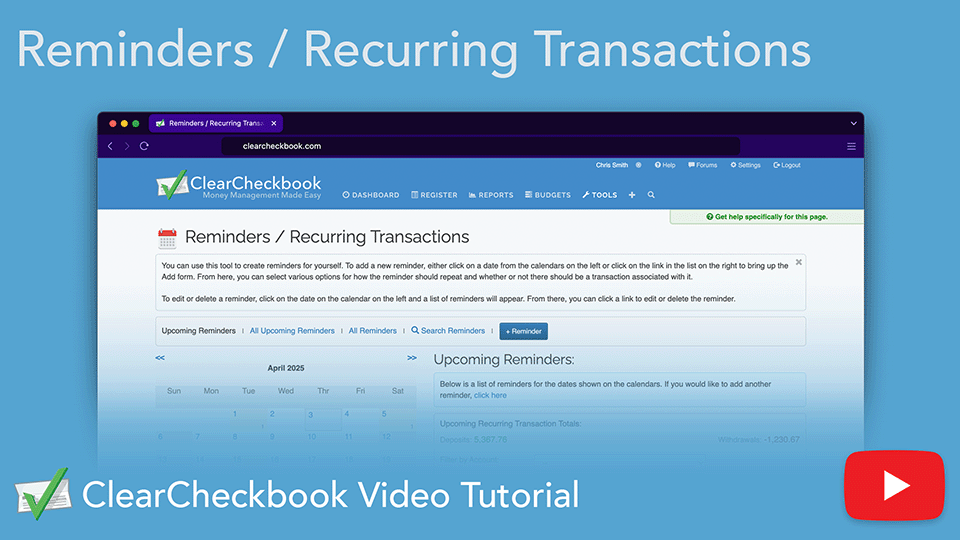

Set up one-time or repeating reminders and recurring transactions to stay on top of bills and future balances. This tutorial shows how to create, manage, and automate financial tasks using ClearCheckbook's scheduling tool.

Direct link to YouTube

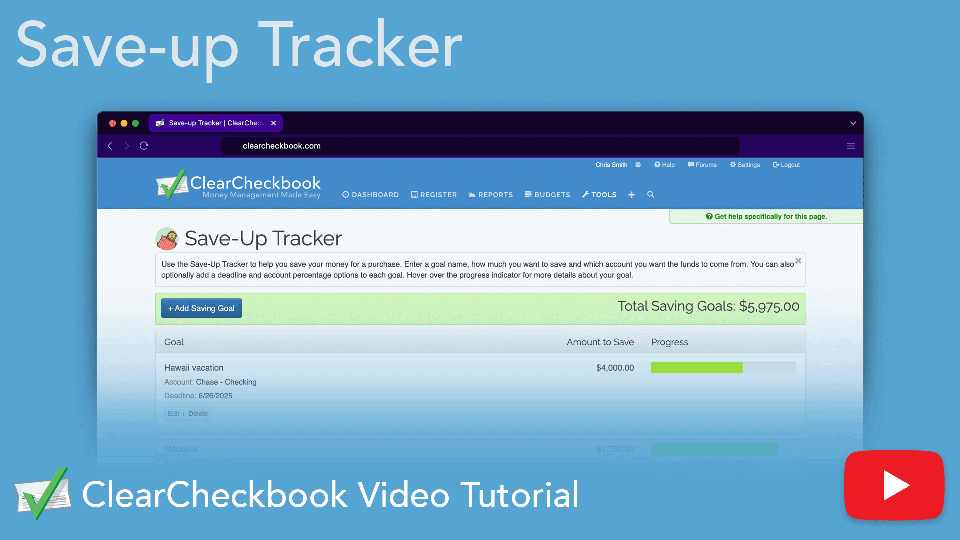

Stay motivated and on track with our Save-up Tracker. Define your savings goals, assign them to accounts, and watch your progress grow automatically based on your balance or manual adjustments. It's the smart way to prepare for big purchases and financial milestones.

Direct link to YouTube

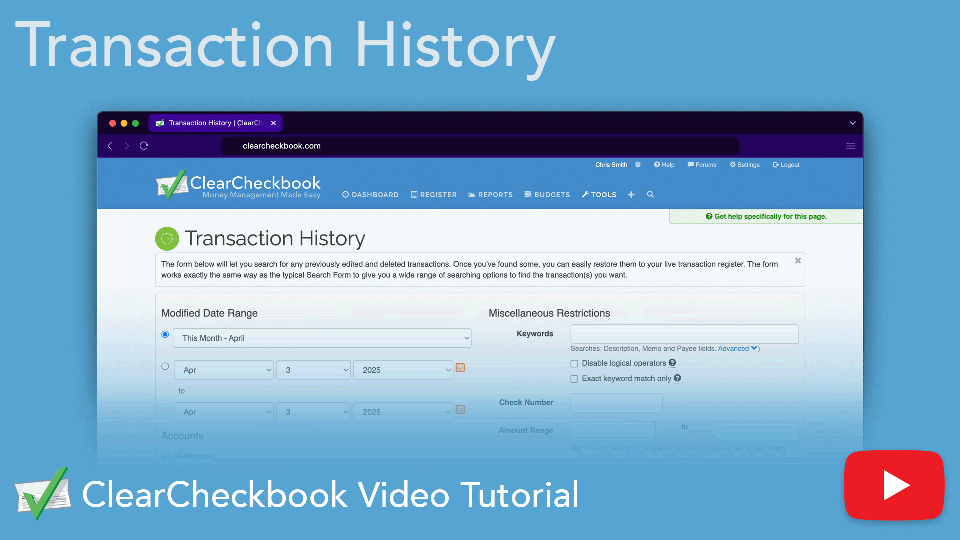

Accidentally edit or delete a transaction? ClearCheckbook's Transaction History tool lets you view and restore past changes from the last four months. Filter by type, view original details, and easily undo mistakes with just a click.

Direct link to YouTube