Credit scores are one of the most important factors when it comes to getting loan approvals or getting good interest rates on those loans. If you have poor or bad credit (scores below 650) then it would be in your best interest to work on raising your score.

This blog post covers how your credit score is calculated and gives you some advice on ways to help raise your score.

Find your Credit Score / Credit Report

Before getting started we recommend checking your credit score and getting your free annual credit report. Your credit report will list all inquiries, outstanding loans and debts and all lines of credit. You’ll use this report to track down any discrepancies and work with debt collectors to lower or drop some of your outstanding debts. In the United States, you can obtain your credit report for free through

AnnualCreditReport.com. This is what the credit rating agencies use to determine your credit score.

The Consumer Financial Protection Bureau

provides some information on how to get your credit score. If you already have a credit card you should check to see if they provide you with your score for free. We know that both Chase and Capital One customers can check their credit score for free.

How is your credit score calculated?

Since the credit reporting companies (Equifax, Experian and TransUnion) use proprietary formulas to determine your scores, there is no way to know exactly how your score is calculated but there has been a lot of research done and some general guidelines can be used. What is known is that the calculation is broken into five major categories with varying levels of importance, all of which are taken into account when determining your overall score. These categories are (in order of importance):

- Payment history (35%)

- The payment history category is determined by looking at how well you’ve paid your prior obligations. Past issues such as bankruptcy and delinquency are also factored into this category. The severity of issues, time it took to get resolved and how long since the problems are also factors in determining this part of your score.

The best way to keep this portion of your score high is to pay your debts early or on time, every time.

- Amount owed (30%)

- This is how much you currently owe to lenders. This category looks at current amount of debt and the number of different types of debt you currently have. If you have many different lines of credit, loans or debts, this will adversely affect your score.

There is also a ratio called the 30% Credit Utilization Rule that says your score is negatively affected if you currently borrowed more than 30% of your credit limit, not just for your overall combined limits but for each individual line of credit. This means if you have a $1,000 credit limit on a credit card and you spend $400 one month, your score could take a slight hit. Keeping your spending low will help improve your credit score.

- Length of credit history (15%)

- There’s not much you can do to affect this one. This is how long you’ve had lines of credit open. The more credit history you have the better your credit score will be. Someone with 10 years of on-time payments is a lot less risky than someone with 1 year of on-time payments in the eyes of creditors. Keep in mind that closing old credit cards can have a negative impact on your credit score since the history associated with those cards will be removed.

If you don’t already have any lines of credit, it’s recommended that you open a credit card (more about that below) to start building some history.

- New credit (10%)

- If you’re constantly opening new lines of credit this is seen as a negative in the eyes of the credit reporting agencies. Opening new cards can be seen as you having financial pressures which indicates problems to them. Opening one new card isn’t going to greatly affect your score but opening 5 new cards probably will.

- Type of credit used (10%)

- Having a mix of credit types is seen as a positive to the credit reporting agencies. This means someone with on-time payments to a mortgage, auto loan and credit cards is a lot more trustworthy than someone who only has on-time payments made to one credit card.

This is a relatively small percentage of your credit score though so it’s not recommended to go out and get a new loan just to try and improve your score.

Improving your credit score:

It becomes a lot easier to work on improving your credit score now that you know the factors that determine your credit score. If you already have one or a few credit cards, the most important thing you can do is make sure you’re not maxing the card out (try to stay below that 30% of credit limit rule) and paying your bill on time.

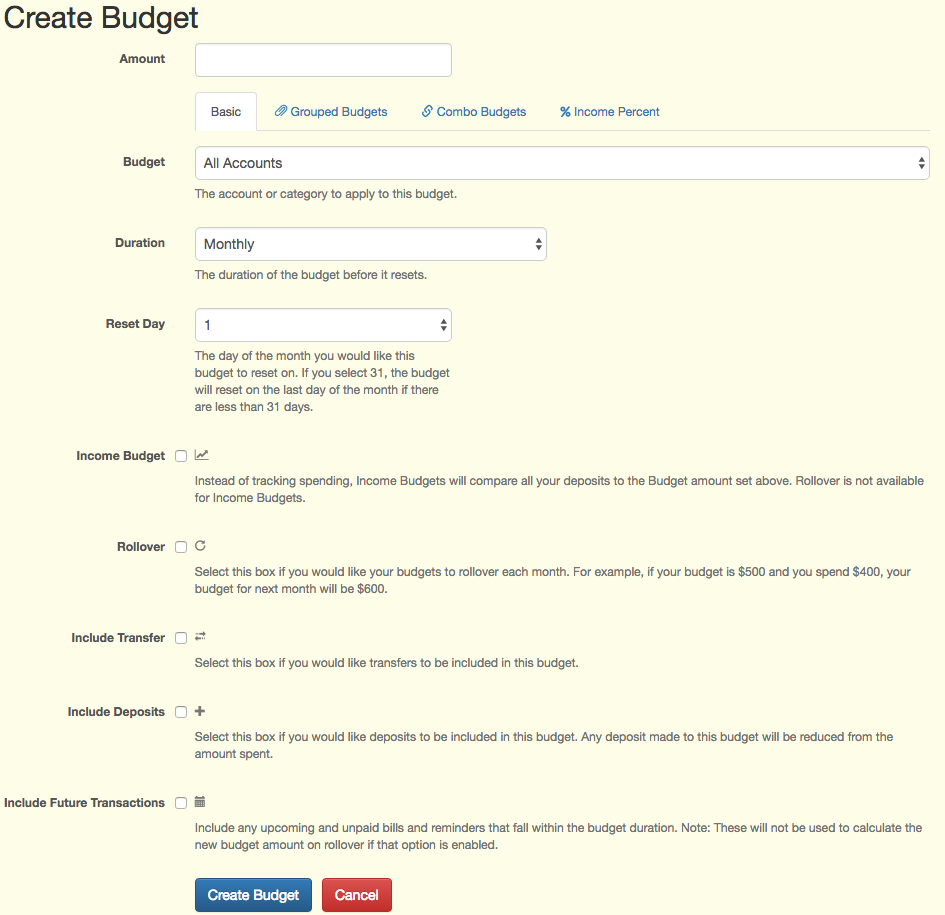

If you’re having trouble staying below the 30% rule,

make sure you’re properly tracking your spending in ClearCheckbook and look for areas you’re overspending and can cut back on. One extremely easy way to keep your spending low and to ensure you pay on time is to use your credit card for one thing per month, like buying a tank of gas, and then immediately pay the bill when the transaction posts. This will keep your payment history excellent and you’ll also keep your debt utilization low which is very important.

Raising your credit score above 700

The technique below was taken by researching what others have done to raise their score from the 500’s up into the 700’s. We don’t guarantee that these techniques will work for everyone and the issues might not be the same ones you face which are causing you to have a low score. We hope you can take some ideas from this and apply it to raising your score.

Step 1: Get your current credit score

The first step to raising your credit score is to know what your current credit score is. We mentioned a few ways you can get your score earlier in this post but you can also sign up for a free service like Credit Karma that lets you regularly track your credit score. Credit Karma doesn’t require any billing information and is legitimately free. They make their money off targeted advertising based on your credit history.

Credit scores range from 300-850 and are broken into a few categories based on your score. The score categories are: 500 or below = bad; 550-649 = poor; 650-699 = fair; 700-759 = good; 750 and above = excellent.

Step 2: Get your full credit report

Next, you’ll want to get a full credit report that lists all accounts. Use this report to find any accounts that are delinquent or have gone to collection agencies. You’ll be using this information in the next step to work on removing some of these delinquent accounts.

Like we mentioned above, you can use

AnnualCreditReport.com to get a free credit report.

Step 3: Dispute debts / Negotiate with debt collectors

Call each of your accounts and dispute each one. The hope here is that they can’t prove the account is real or that they followed the law in regards to the

Fair Credit Reporting Act (FCRA) and they will remove the account from their system, and thus, your report. Also ensure that any debt collectors that have contacted you are adhering to the

Fair Debt Collection Practices Act. If you believe a collection agency is breaking the terms of this act you can file a dispute with the Consumer Financial Protection Bureau.

For the remaining delinquent and/or other accounts in collections that weren’t removed, work on negotiating down the debt. Call the account holders and let them know you can’t afford to pay the entire debt but want to settle now and can pay them a certain amount (target about half of what the debt amount is). You’ll probably need to speak to a manager to get this approved but this can greatly reduce the amount owed.

An additional option is to sign up for a service that sends letters on your behalf to your remaining accounts demanding that they show proof and accuracy of any negative items on your credit report. These services do charge either an upfront or monthly fee so they may not be for everyone. While you might have ethical issues with using a service like this, it has helped people in the past get items removed from their credit report.

After doing all of this the goal is to have removed or reduced the amount owed to as many of your accounts as possible which should make it easier to pay them off.

Step 4: Pay off any remaining delinquent accounts

After negotiating debt reductions you’ll need to pay off your existing debts. If you have the money available then you should pay off the debts immediately. If not, we recommend using the ClearCheckbook

Debt Snowball Tool to manage your debt payments. Paying off your existing debts will dramatically improve your credit score since the amount of debt you owe makes up 30% of your credit score.

Step 5: Start building good credit

Because payment history makes up the biggest portion of your credit score it’s important to have a good track record of on-time payments. One way to do this is to get a credit card and make one purchase per month and immediately pay the card off. An extremely easy way to do this would be to use the card once per month to buy a tank of gas for your car.

Depending on your current credit score you might not get approved for an actual credit card. If that’s the case you can sign up for a

secured credit card. Secured credit cards require that you essentially pre-pay the card with a certain amount. Credit limits on these cards are generally low but that’s OK since all you care about is making the one small purchase and immediately paying it off in full each month.

Step 6: Continue with on-time payments / building credit

Since the most important aspect of your credit score is your payment history, it’s extremely important to continue to pay your loans, credit cards and bills on time. If you had a secured credit card and have been using that to raise your score, see if you can open a traditional credit card and continue making a small purchase on that and then pay it off in full each month.

Having a few different lines of credit is always a good thing but that doesn’t mean you should go buy a new car just to get an auto loan. Make sure you can afford to purchase a new vehicle or home if you’re planning on opening a new line of credit.

Step 7: Work with any account holders to remove late payment reports

This falls into the “it never hurts to try" category. If you made some late payments to a credit card or auto loan in the past but have had good payment history since then, you should try calling the companies and asking them if they will remove the late payment notices from your report. This plays into the ‘Payment history’ category which is the biggest factor to determining your credit score. If the companies will remove these late payment notices then it can have a dramatic effect on your score.

Hard vs Soft Pulls

One last thing we wanted to mention before wrapping up this blog post are the two ways your credit score can be accessed. When you check your credit score through a service like Credit Karma or through your credit card’s website, these are soft pulls and do not affect your credit score at all. Hard pulls are made when applying for a loan, a new credit card, or anything that requires a company to check your FICO score. Hard pulls do affect your credit score and will remain as inquiries for several months.

Final words

There’s a lot that goes into determining your credit score. The most important things you can do are to pay your bills and debts on time, stay within the 30% rule and don’t open as many lines of credit as possible. Everything in this post is meant to provide some information and some possible ways for you to raise your credit score. We encourage you to do some follow up research on your own before attempting any of the techniques in this post.

This is part of our weekly

Money Management Tips series that aims to help you take more control of your finances. This series gives tips on everything from tracking your spending to improving your credit score.