As we enter 2020, this New Year in particular is proving to be a popular time to set resolutions and goals for self-improvement. Due to it being the beginning of a new decade, more people are deciding to put their shoulder to the wheel and achieve their biggest dreams and aspirations for the next ten years. Stay on track with your resolutions by following some basic guidelines.

According to research, one of the most popular resolutions is improving one’s finances,

with over half of those studied having some financial goals on their list. Unfortunately, resolutions are often very ambitious and fall apart soon after they’re made—56% of those surveyed stated that they were never able to follow through.

But is this really due to the failure of people’s ambition? One could argue that the real reason resolutions don’t succeed is because we’ve never truly learned the proper way to go about a resolution. So if you’ve set a financial goal for the next year, or even decade, and are worried about losing track of it, here are some tips on how to best stick to it!

Say No to Vague Goals

The best personal finance goals are the ones that are clearly defined because they’re the hardest to stray from. They also require more thought and planning than a vague goal. For example, if a person decides their financial plan for the new year is to “save more money,” they may have no path laid out on how to complete this. In addition to that, they could have no way of gauging when they’ve achieved success, which can make it easy to give up.

Instead, choose goals that have clearly defined ways to be completed. Instead of saying you want to save more, go into your savings account and see how much you saved on average last year. Do this by taking the amount of money you put into your savings account and divide that by 12, so that you know how much money you saved every month. Now make it your goal to save 25% more than that last year, or maybe even 50% more. This could mean going from putting $100 into savings every month, to $125-$150. Now you know what your goal is, can reasonably measure it, and have a set strategy in place for how to achieve it.

Here is a list of actionable goals you can set, compared to more common, vague, financial goals:

| Vague Goals | Actionable Goals |

|---|

| Improve your credit score. | Bring my credit score up by 50-100 points by making monthly payments on time and keeping my card balance below 30%. |

| Save for retirement. | Start contributing 5% of my income to a 401k or Roth IRA every month and meet with my employer to find the best options. |

| Make more money. | Earn $1000-$2000 more this year by investing in dividend-yielding stocks, creating a side hustle, or working towards a promotion. |

Automate What You Can

One of the other issues with resolutions is how easy it is to simply forget or get distracted from your original plan. The daily bustle of life can be incredibly hard to navigate, and adding a new routine to this certainly doesn’t ease the struggle. In order to get around this, use the latest technology to automate your financial strategy.

New fintech apps and software are being developed constantly that help users manage their finances, and it’s important to make the most of this if you really want to have the best chance of achieving success. The benefits of these platforms are that most of them allow for some form of automation, meaning they’ll be doing the work for you, or making the work easier to complete from your smartphone or laptop.

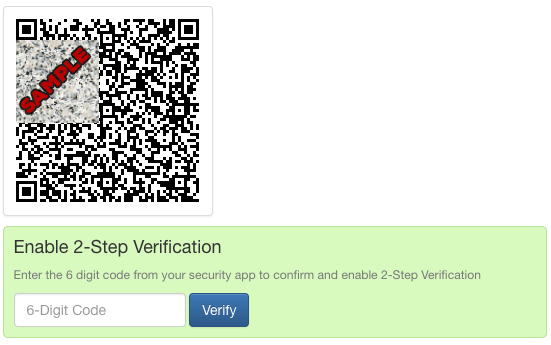

To get started, sign up for a

ClearCheckbook account if you haven't already done so. Our tools and features help you manage all areas of your finances from reporting to budgeting and account balancing. You can also

look into online bank accounts with helpful features such as automatic savings, so that every time you make a purchase or receive a paycheck, a small amount of money goes into your savings account without requiring any extra work.

Find Support

For those who complete their New Year’s Resolutions, many find that one of the things that drives the most success is having a third party to push them to complete their goals. For those trying to get in shape, this could mean involving a friend in their fitness journey or meeting with a personal trainer every few weeks to monitor their progress and give them advice.

The same principle holds especially true with one’s finances. Most people get emotional when they manage their money, and this can lead to hasty decisions being made that end up hurting them in the long run. Some examples may include not budgeting properly, making investments that are too risky, or overestimating what you can realistically achieve in a year. Consider talking with a financially savvy friend to discuss your strategy and get a second opinion on your plan. If you’re able to spend the extra money, meeting with a certified financial planner could be a great way to really see your money grow, and have the support to continue sticking to your financial goals.

Don’t Get Discouraged

While all of these strategies play an important role in helping complete New Year's Resolutions, it’s important to also remember that no one is perfect, and everyone is going to have slip-ups along the way. This is also where most resolutions fall apart because they can lead to a negative mindset. When someone overspends one day, their logic might be “I’ve already overspent today, so what does it hurt if I miss my goal tomorrow?” This leads to a negativity cycle which eventually causes the entire resolution to fall apart.

Instead, create a mindset where each failure becomes a learning opportunity. If one month you missed a credit card payment and are worried about a negative impact on your credit score, plan to spend less the next month so you can make more than the minimum payment going forward. By doing this, you’ve created a better opportunity for yourself by accepting a small failure.